Avalara Integration

Date Released: August /Sept 2017

Modules: The Avalara Tax calculation integration is only available in Navigator. It is used in the following parts of the system:

- Navigator Orders: Customer Order, Quote, Direct Ship, Credit Order for Sales and Use Tax

- Navigator Invoicing for Sales and Use Tax

- Navigator Credit Manager

- CMS / EDI - 850 - Order Creation and 810 Invoices

- Decor24 - Order Creation and Display

- Sales Portal - The Tax field in several locations shows the Avalara tax calculations.

- Selection Sheet Manager - Avalara tax calculation is enacted during Order Creation.

Description: Implement Avalara AvaTax for calculating tax on customer orders and invoices.

Reason for Change: Simplifies tax calculation.

When this functionality is turned on and set-up, the 3rd party Avalara AvaTax is automatically and seamlessly used for tax calculations.

Assessing Taxes on Orders via Avalara

- After the set-up is performed, the Avalara tax calculations in Navigator Order Entry are seamless and done behind the scenes.

- The taxes are automatically calculated and assessed during Order Entry and invoice creation.

- When Invoices are created the transaction is Committed in Avalara's system. It can be reversed by voiding the invoice (which can only be performed on Today's Invoices).

- Once Night Jobs runs the final tax value is stored in the Invoice file.

- To see your committed Invoice transaction, log into your Avalara portal.

Set-up

The following areas of the system have set-up needed:

Company Settings - Menu Option SET 3

Credit Manager

3rd Party Configurations menu

Use this menu to enter the information needed by Avalara to interact with and get tax information from their application.

Select option 1 - Tax Service Providers and then update the Avalara service provider record. A screen similar to the one shown below appears.

The information on the Service Provider Profile Maintenance screen shown above is provided by Alavara. It allows them to know who is accessing their system so they can grant access to the tax information.

Company Settings - Menu Option SET 3

This setting turns on the Avalara Tax functionality for an entire company.

Enter a "4 to access the Tax options.

Ensure the Use External Tax Institution setting is set to "Y and "AV" is entered as the Institution.

File Management

Item File - Navigator File Management

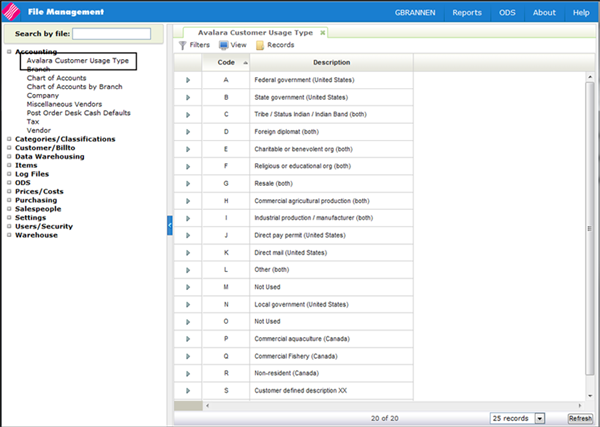

Avalara Customer Usage Type

After Avalara has been activated, via SET 3, the file Avalara Customer Usage Type is displayed in File Management.

The file comes with 18 pre-loaded entries; as shown above. The Codes (A-R) cannot be changed. However, the descriptions can be updated.

These codes determine if an order or order line is tax exempt.

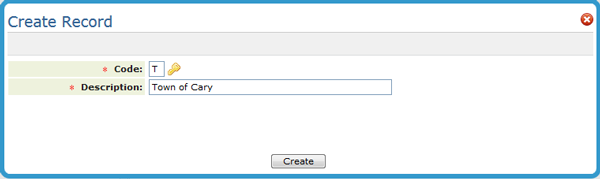

To create a new record, click Records and then select Create.

Keep in mind that the new code also needs to included in the Avalara portal.

Item File - Navigator File Management

The Product Tax Code setting has been added to several Item File windows.

The Product Tax Codes are established by Avalara and accurately represent the type of item.

For a complete listing of all the Product Tax Codes, refer to http://taxcode.avatax.avalara.com.

Item Create and Update windows

Filters window

Tax Exemptions

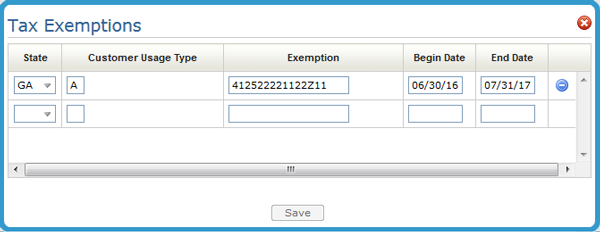

This option maintains exemptions by customer, by state or province, with start and expiration dates. If this file is activated, tax exemptions for each order will be checked, based upon the customer account# and the state into which the material is being shipped, or the state assigned to the warehouse from which a will-call is made. If an exemption record is found for that account and state, and the current date is within the start/expiration date span of the exemption, then the order will be considered non-taxable (tax exempt).

The Customer Usage Type, in the example above "A", is validated against the Avalara Customer Usage Types established via File Maintenance. When tax exempt orders are created, this value is used to tell Avalara that the order is tax exempt.

For more information on Avalara, refer to Avalara Integration.

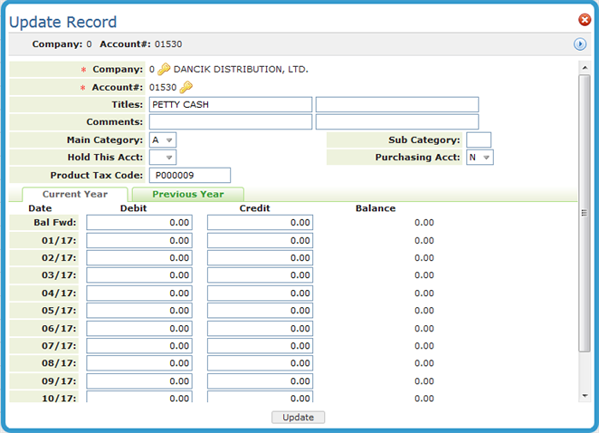

Chart of Accounts File

The Charts of Accounts file includes an Avalara Product Tax Code.

This code is crossed referenced when assessing miscellaneous charges, entered via message lines in order entry, to activate Avalara tax calculations.

When in create or update mode, the Product Tax Code is available for any companies that Avalara has been activated.

Order Management

When creating an order, the system checks to see if the account has any associated tax exemptions.

If there are, the Taxable setting is set to No and the following settings are populated.

Customer Usage Type - This is the value created and maintained via the Avalara Customer Usage Type in File Management.

Tax Exempt ID - This number is pulled in from the Tax Exemptions Table (Menu option SYS 605).

Reason - A reason is mandatory for nontaxable orders. The reason gets included on the notepad of the order. If a tax exemption record is found and Taxable is set to N the Reason field is not required. It is only required when the Taxable option is changed. Essentially, switching back and forth between taxable and non taxable requires a Reason to be entered.

Notes

- If there are no Tax Exemptions set up for the account, the order can manually be made nontaxable. The Customer Usage Type, Tax Exempt ID and Reason settings have to be manually entered.

- If the Taxable setting is "Y" the settings become inactive.

Always Taxable Items

Items can be made always taxable in the Item File.

If you change an order to nontaxable that contains order lines with always taxable items, you will receive the following Notification.

Click Close to return to the order.

The tax status of the line can be changed by clicking the line options arrow and selecting Taxable/NonTaxable.

Order Notepad

Changes to an Order's or Order Line's taxable status are noted under the Tax History tab in the order's notepad.

Use Tax Calculation

The existing Ship Via Classifications setting (FIL 19) Show Estimated Use Tax for this ship via is used to control whether Use Tax should be calculated for order instead of Sales Tax.

When set to Y, and the corresponding ship via assigned to an order, Avalara calculates the Use Tax for the entire order. When set to N, Avalara calculates Sales Tax.